|

As part of our merger with ChoiceOne Bank, we want to ensure a smooth transition for all our customers. Please take note of these reminders to prepare for the change and to set up your online banking account.

Before March 14:

-

Download Statements: Ensure you download and save all your recent bank statements and tax documents for your records.

-

Note Recurring Transactions: Review and make note of any transactions that are configured to recur. These transactions could be ACH, Wires, or Bill Payments.

-

Back Up QuickBooks/Quicken: Before becoming a ChoiceOne customer, back up your data in your accounting software.

-

Back Up ACH Batches and Wire Templates: Back up any ACH batches and wire templates to avoid disruptions in your payment processing.

-

ACH debit originators: notify your vendors of the new routing number (072408436) prior to sending the first batch in case your vendor uses ACH blocks.

Please note that the last day for businesses to submit ACH files and Payroll is March 12th.

Starting on March 17:

-

Login:

-

If you are currently enrolled in online Wires, ACH, or Positive Pay products, you will receive an email from ChoiceOne Bank at 9am on the morning of March 17 with a link to establish your new user credentials. Please click the link to complete this process. If you do not see the email, please check your spam folder.

-

Mobile Experience: Please remove The State Bank Mobile App and begin using our mobile friendly website experience at https://treasury.choiceone.bank/pwa/choiceone/

Otherwise:

-

Log in to your new ChoiceOne account using your current username (with any special characters removed) and the last four digits of your business's tax ID number. If you do not know your business's tax ID number or if you have multiple businesses, please reach out to us today to verify it.

-

Mobile App: Please remove The State Bank Mobile App and find the ChoiceOne Mobile Banking App by searching for ‘ChoiceOne Bank’ in the Google Play and Apple App Stores.

-

QuickBooks/Quicken:

-

After logging into ChoiceOne, to connect QuickBooks all you need to do is add your financial institution's information. Here's how:

-

Backup your current settings and configurations of QuickBooks.

-

Go to the Banking tab on the left-hand menu bar.

-

Select the Banking section.

-

Since you already have an account connected, press Add account on the top right-hand corner of the screen.

-

Search for ChoiceOne Bank. If you are on the Treasury Management Platform (doing online ACH, Wires, or Positive Pay) then select ChoiceOne-Treasury

-

Follow the on-screen instructions to successfully log in and connect your bank.

-

Once all the payout clears in the old account, you can disconnect The State Bank account.

If you use our QuickBooks Payments (Merchant Services) feature, then check out this link to help you change the bank information within the Payments settings.

-

Confirm Transfers: Check that all transfers are correct.

-

Users and Entitlements: Log in to your new ChoiceOne account and verify the users for your organization and their user entitlements are accurate.

Important Note: Special characters in usernames will be removed. Please ensure your username complies with this requirement.

|

|

Add the Treasury Platform to the Home Screen on Android

1. Navigate to the Chrome browser on your Android smartphone and tap to open it.

2. Tap on the URL bar to begin.

3. Now type the following and then hit the go button on your keyboard: https://treasury.choiceone.bank/pwa/choiceone/dashboard

4. Login to the Treasury Platform using your user credentials.

5. Once the Treasury Platform is loaded, and you are viewing the Treasury Dashboard, tap on the Chrome menu (three vertical dots) to expand the options.

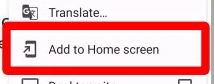

5. Tap on Add to Home screen.

6. Now tap on Add.

7. A pop-up menu will again appear, tap on Add to add the Treasury Platform to the home screen (this step is for Samsung Galaxy users only, other Android users might not get the confirmation twice).

And the Treasury Platform will now appear on the home screen of your Android smartphone.

Add the Treasury Platform to the Home Screen on iOS

1. Navigate to the Safari icon and tap to open the app.

2. Tap on the URL bar.

3. Now type the following and then hit the go button on your keyboard: https://treasury.choiceone.bank/pwa/choiceone/dashboard

4. Login to the Treasury Platform using your user credentials.

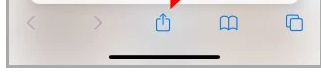

5. Once the Treasury Platform is loaded, and you are viewing the Treasury Dashboard, tap the Share icon in the bottom navigation bar.

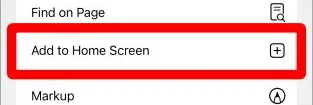

6. Scroll up through the list of options, and tap on the Add to Home Screen button.

7. Now tap on Add to add the Treasury Platform to your iPhone’s home screen.

8. The Treasury Platform’s shortcut will appear on your iPhone’s home screen. Next time, you just tap on the shortcut and it will take you directly to the Treasury Platform. |